Properties JOINTLY provides integrated real estate strategic investment solutions to institutions and qualified investors

Introduction: Why You Are Here

For centuries, real estate has been the cornerstone of lasting wealth. But that’s not all. Nowadays, we can also enhance our investments by incorporating additional leverage through partnerships alongside real estate. However, direct ownership often comes with management burdens and complexities.

This is where Properties JOINTLY Partnership Group comes in (even if you don’t have any capital to invest; instead, you can earn with us simply by referring those who do have capital)

We call ourselves PROPERTIES JOINTLY because we unite diverse PROPERTIES and work collaboratively, embracing a shared vision that thrives JOINTLY in every aspect of our ventures.

Properties JOINTLY Partnership Group offers a seamless path to institutional-grade real estate ownership, starting in the stable and lucrative markets of London and across England. Whether you seek to grow your own portfolio, partner with us as an Investment Partner, or leverage your network as a Referral Partner, we provide the platform for collaborative success. Our PARTNERS page is a starting point with information on how to become our Referral and Investment Partners.

Join the Properties JOINTLY Referral Program:

Ideal for anyone seeking additional earnings, the program offers added benefits for Corporate Service Providers, Legal Firms and Advisors, Broker-Dealers, Real Estate Agents, Accountants, Business and Management Consultants, Wealth Managers, and Public Relations Companies.

Become a Referral Partner with 3 Steps to Start High-Ticket Earning

Step 1: Join

Register today and gain access to your dashboard with your personalized referral link, which works uniquely and effectively.

Step 2: Refer

Share your unique link across your network, social platforms, blogs, or directly with investors and clients.

Step 3: Receive

Earn various incentive and recurring commissions based on your inputs for every successful transaction.

Properties JOINTLY Co-Investment Platform:

We operate a platform connecting experienced partners to joint property ventures across the UK. Each project is independently structured, and participation details are available only to self-certified investors upon registration.

Our goal is to partner with you through Properties JOINTLY. It is to help you preserve purchasing power and generate steady, resilient returns over time. Let us introduce you to a better way to invest, together.

Professionally Valued and Vetted Real Estate Opportunities by Our Team of RICS Chartered Surveyors (MRICS):

- All opportunities undergo RICS-compliant due diligence to ensure transparent and informed decision-making.

- Partners benefit from access to professionally appraised assets and market-aligned insights.

- Our collaborative approach focuses on value creation through improvement, not speculative yield.

We welcome joint venture discussions with aligned partners seeking to co-develop or reposition assets underpinned by RICS valuation standards.

Institutional Partnership Opportunities: Real Estate Investments with Properties Jointly

Our Geographic Focus: We have deep expertise in the resilient markets of London and England, providing a solid foundation for our initial investments. This focused start gives us the strategic strength to scale our partnership model globally. We specialize in curating institutional-grade portfolios for qualified and institutional investors, leveraging the timeless value of brick-and-mortar assets alongside the strategic advantages of joint venture partnerships. Our vertically integrated approach allows us to manage the entire investment lifecycle – from sourcing and joint venture structuring to value-add development and property management – ensuring optimal performance and security.

Our Partnership Model: We believe in growth through collaboration. Our business is built on uniting Referral and Investment Partners in joint ventures. This creates a powerful ecosystem where expertise, capital, and networks align to share in the rewards of strategic real estate asset investments.

UK Real Estate: Upward Trend

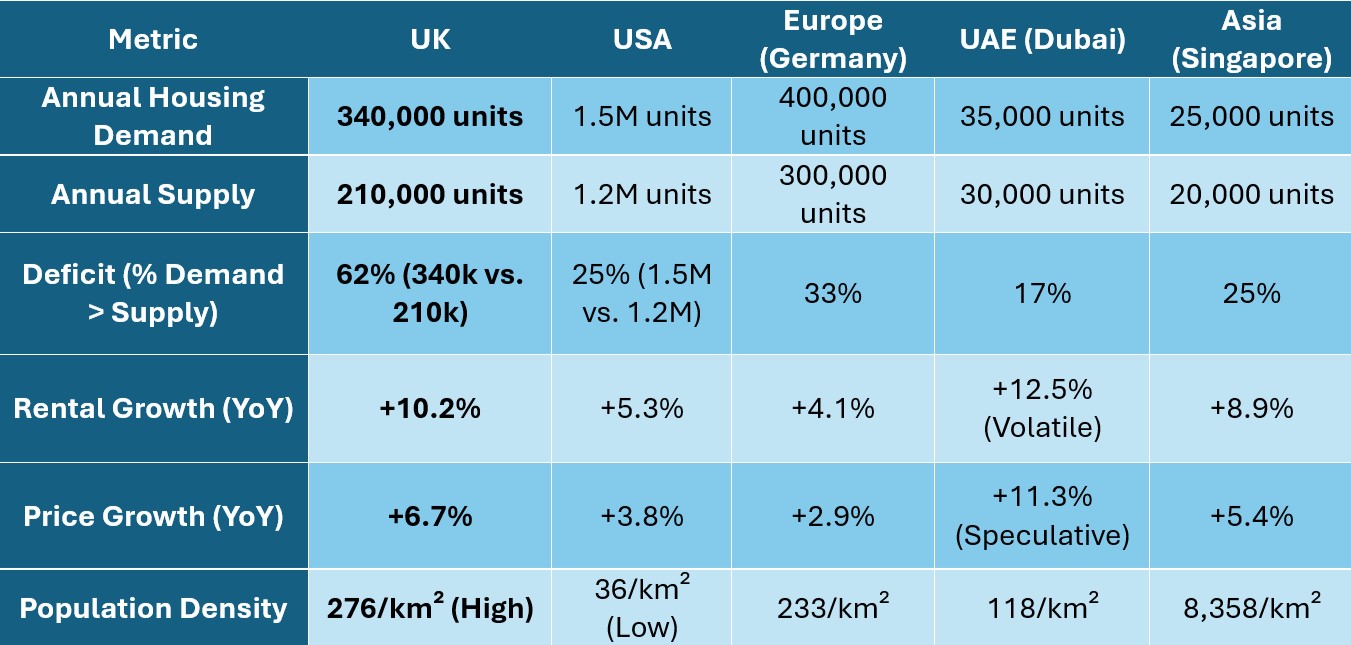

UK vs Global Real Estate Markets: Demand vs. Supply

UK vs Global Real Estate Markets: Demographic & Geographic Edge

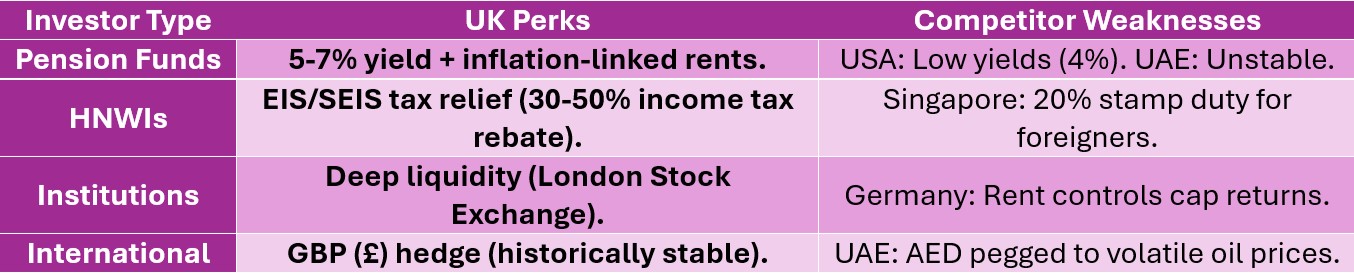

UK vs Global Real Estate Markets: Investor-Specific Benefits

(Sources: Savills, ONS, Zoopla, Knight Frank)

1st & 3rd Wednesdays Every Month

Live Investor Q&A Zoom Call

Opportunities & Strategies

Join our briefing for only the first 100 booked investors, examining real estate projects and portfolios. We’ll analyze current market trends, cash flow optimization strategies, and performance metrics, showing how they combine real estate’s stability with asymmetric growth potential, followed by a Q&A session.

2nd & 4th Wednesdays Every Month

Investor Roundtable Reception

Booking Fee: £25 per Person

Join our exclusive partnership dinner at one of London’s finest restaurants for presentation-style discussions on investment portfolio strategies, networking with like-minded investors, and market insights that combine real estate’s stability with the potential for wealth growth. This in-person gathering is limited to pre-qualified guests.

Investment Disclaimer

The fundamental purpose of any business is to acquire assets and invest capital. It is essential to recognize that all investments, including real estate, inherently carry a risk of loss. Past performance does not guarantee future results, and market conditions are inherently unpredictable; ultimately, nobody can know what will happen tomorrow. All markets are cyclical, experiencing both appreciation and depreciation, and real estate values are constantly influenced by a myriad of economic, regulatory, and local circumstances. Hence, no guarantees of return and no assurance can be given that investment objectives will be achieved.

Please Note: We do not provide tax or legal advice. You must consult your own qualified advisors.

Although our team of real estate professionals exercises caution, prudence, and expertise in analyzing every opportunity, there can be no absolute guarantee that our projections will be realized. Therefore, each investor must conduct their own independent due diligence. Ultimately, an investment itself is not inherently risky; the risk lies with an unprepared investor. The key to any sound investment is the accurate evaluation of risk versus reward.

Important Distinctions for Investors:

Investment Partnerships: By investing as a capital partner (investor) with Properties JOINTLY, you engage in a Partnership and/or Joint Venture (JV). Properties JOINTLY Group adheres strictly to financial regulations. All registered investors are required to complete standard verification procedures, including Anti-Money Laundering (AML) and Know Your Customer (KYC) checks. Our compliance team will carry out this verification and will notify investors accordingly.

For comprehensive details, please review our full Disclosures and Terms & Conditions.

* * *

This website is directed by Properties Jointly group of companies (“PJ”) only at persons to whom we can legally provide the information contained on this website. No opportunity to participate in any investment transaction will be made in any jurisdiction in which such an opportunity is not authorised, or to any person to whom it is unlawful to provide such an opportunity to participate.